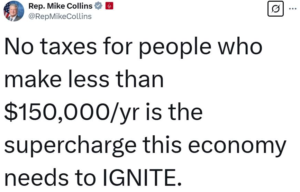

Recent discussions have emerged regarding potential changes to the U.S. federal income tax system, particularly proposals that could eliminate income taxes for individuals earning less than $150,000 annually. Here’s an overview of the developments:

Trump Administration’s Proposal

On March 13, 2025, U.S. Commerce Secretary Howard Lutnick stated that President Donald Trump aims to waive federal income taxes for Americans earning under $150,000 per year, contingent upon achieving a balanced federal budget. Lutnick described this initiative as “aspirational,” indicating that while it’s a goal, its implementation depends on future fiscal conditions.

Abolition of the IRS and Alternative Revenue Sources

Further reports suggest that President Trump is considering abolishing the Internal Revenue Service (IRS) and eliminating federal income taxes altogether. The administration proposes replacing this revenue by imposing tariffs on imports from other countries, effectively having foreign entities contribute to U.S. federal revenues. In 2024, individual income taxes constituted approximately 49% of the federal government’s $4.92 trillion revenue. Shifting to a tariff-based system would represent a significant transformation in U.S. tax policy.

Historical Context and Previous Proposals

The concept of exempting a substantial portion of the population from federal income taxes isn’t entirely new. For instance, the Competitive Tax Plan, proposed by tax law professor Michael J. Graetz, suggested implementing a value-added tax (VAT) of 10–15% and reducing personal and corporate income taxes. This plan aimed to exempt families earning less than $100,000 annually from income taxes, simplifying the tax system and potentially boosting economic competitiveness.

Current Tax Structure

As of the latest available data, the U.S. federal income tax system is progressive, with multiple tax brackets. For single filers in 2023, the marginal tax rates are as follows:

- 10%: $0 – $11,000

- 12%: $11,001 – $44,725

- 22%: $44,726 – $95,375

- 24%: $95,376 – $182,100

- 32%: $182,101 – $231,250

- 35%: $231,251 – $578,125

- 37%: $578,126 and above

-

Under this structure, individuals earning up to $150,000 fall within the 24% marginal tax bracket. Eliminating income taxes for this group would significantly impact federal revenue and necessitate alternative funding mechanisms.

Considerations and Implications

While the proposal to eliminate federal income taxes for those earning under $150,000 is ambitious, several factors must be considered:

-

Revenue Replacement: Federal income taxes are a major revenue source. Replacing them with tariffs or other taxes would require careful planning to avoid budget deficits.

-

Economic Impact: Shifting to a tariff-based revenue system could affect international trade relationships and domestic prices, potentially leading to inflationary pressures.

-

Feasibility: Balancing the federal budget is a complex challenge. Achieving this goal is crucial before implementing such significant tax reforms.

As discussions progress, it’s essential to monitor official announcements and legislative developments to understand the potential trajectory of U.S. tax policy.

-